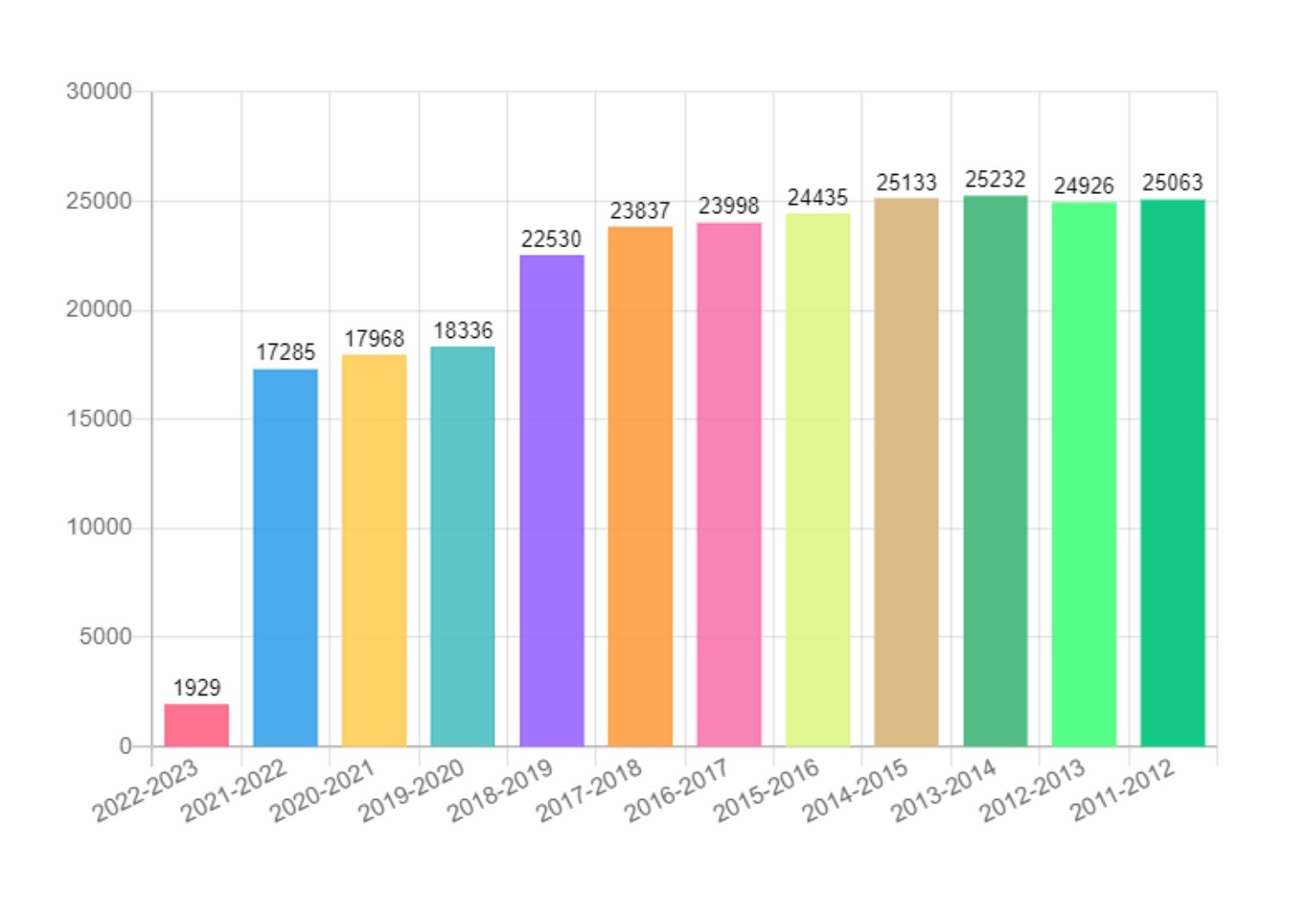

New Delhi, October 20, 2023. The FCRA Annual Return for the 2022-23 financial year represents the lowest submission rate in the past 10 years. According to the FCRA 2023-23 Annual Return Data Dashboard, there has been a significant decrease in the submission of financial documents by all categories of FCRA associations, including Active or Alive/Deemed ceased or Expired/Cancelled.

As of October 19, 2023, the Ministry of Home Affairs (MHA) FCRA Annual Report Data Dashboard indicates that only 1929 NGOs registered under the Foreign Contribution Regulation Act have submitted their annual financial statements. This number marks the lowest submission rate over the last decade. Notably, in the financial year 2021-22, the MHA received a total of 17,285 submissions of financial annual reports.

Read Detailed Coverage: MHA mandates FCRA-registered NGOs to give full details of assets generated through foreign funds

Between 2020-22, above 17 thousand FCRA Registered Societies have submitted their annual financial report. The number of FCRA AR submissions has seen a declining trend in the last 10 years. In 2011-12, a total of 25063 FCRA AR was filled and till this year the number has decreased to 1929 only. For a detailed reading on Why only 14% of NGOs have active FCRA Associations: Violation of Foreign Contribution Regulation Act; MHA cancels CARE India’s FCRA license

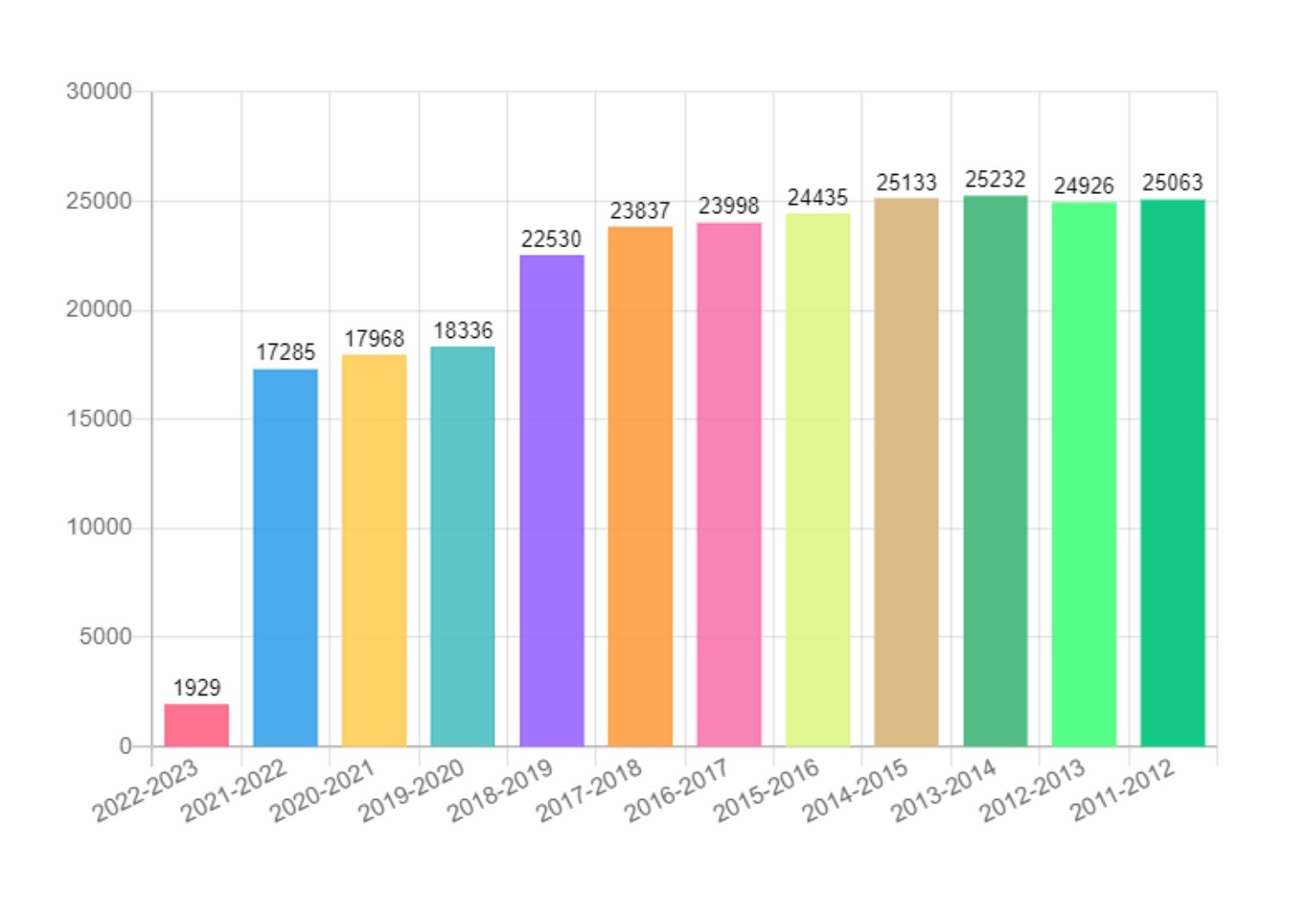

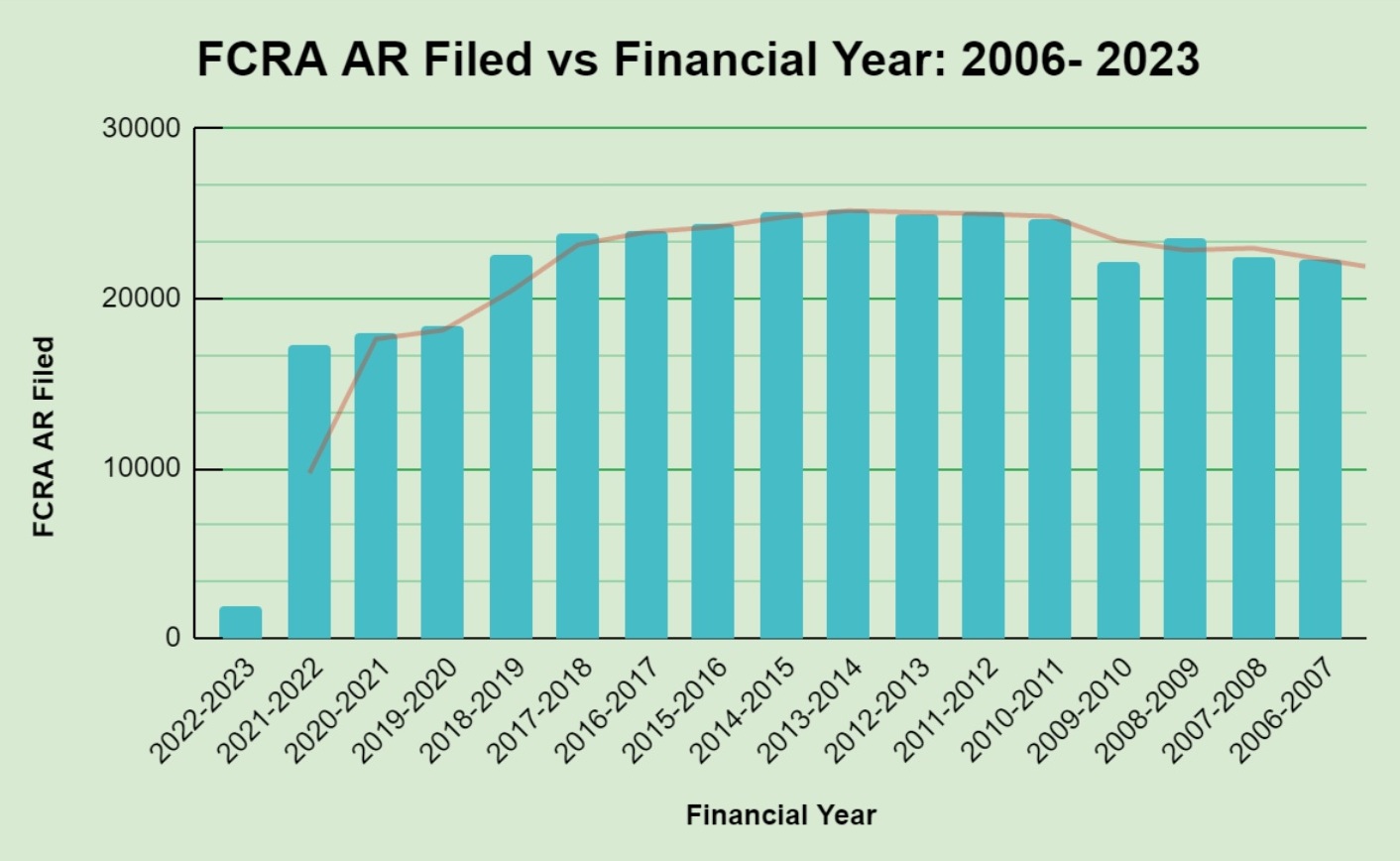

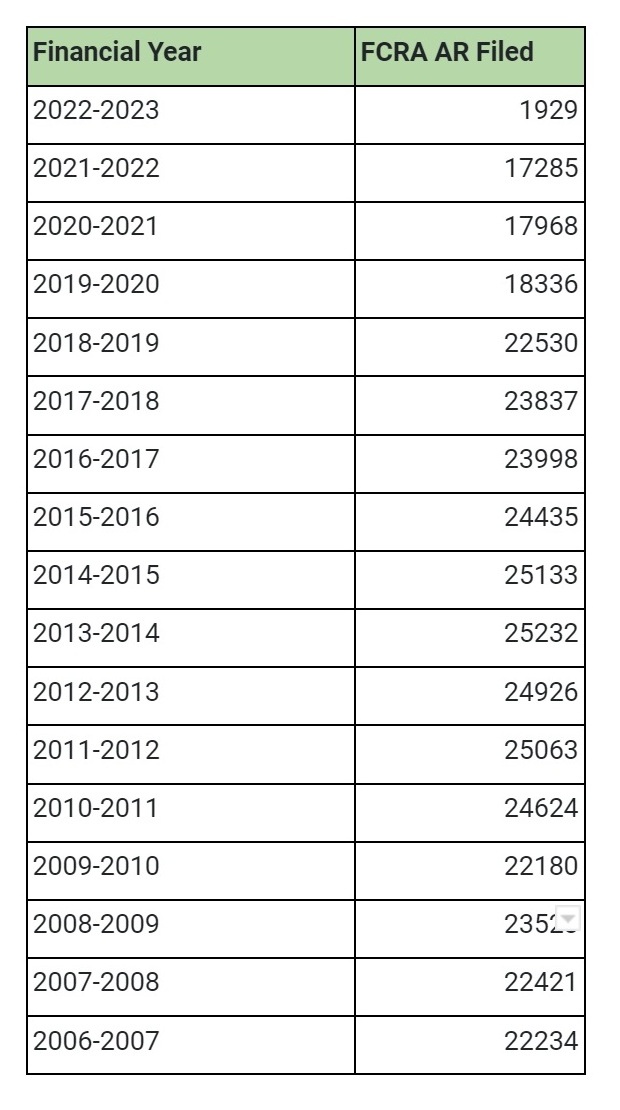

MHA Reports on FCRA Annual Returns Filed in the last 10 years (Dated: October 19, 2023)

The below data shows the sharp decline in the FCRA Annual Report filled by the NGOs, Organisations or Civil societies in the last 10 years. The data is taken from the MHA website (Source: https://fcraonline.nic.in/fc_dashboard.aspx)

Latest on FCRA: Delhi HC allows release of Funds for Centre for Policy Research amid FCRA license suspension

16,917 FCRA Registrations in India: And only 1929 Annual Report submitted by FCRA Certified NGOs

As per the current status of FCRA in India, out of a total of 1.12 lakh registered FCRA NGOs, only 16,917 are actively working in various social works through foreign funding. Based on the data dashboard, less than 2% of actively working FCRA-certified agencies have submitted their annual financial statements in 2022-23.

Five most important questions you should know on FCRA Filing of Annual Returns

Question 1: Is online submission of annual returns mandatory?

Answer: Yes. Annual returns are to be filed online at fcraonlineservice.nic.in. No hard copy of the returns shall be accepted in the FCRA Wing of the Ministry of Home Affairs.

Question 2: What is the last date for online filing of returns?

Answer: The return is to be filed online for every financial year (1st April to 31st March) within a period of nine months from the closure of the year i.e. by 31st December each year.

Question 3: What is the procedure for filing Annual Returns?

Answer: The Annual return must be filed online at fcraonline.nic.in in the prescribed Form FC-4, along with a balance sheet and a statement of receipt and payment, both certified by a Chartered Accountant. It is compulsory to submit a 'NIL' return, even if no foreign contribution has been received or utilized during the year. In such cases, uploading an audited statement of accounts is not required, although a certificate from a Chartered Accountant is still necessary. More detailed information can be found in Rule 17 of the Foreign Contribution (Regulation) Rules, 2011 (FCRR, 2011).

Question 4: For how many years should an association that has been granted prior permission to receive foreign contributions file the mandatory annual return?

Answer: The association should fill the mandatory annual return on a yearly basis, till the amount of foreign contribution is fully utilized. Even if no transaction takes place during a year, a NIL return should be submitted.

Question 5: What are the consequences of not filing the annual returns on time?

Answer: An association not filing annual returns on time may face the following consequences:

- Imposition of penalty for late submission of return.

- Cancellation of registration

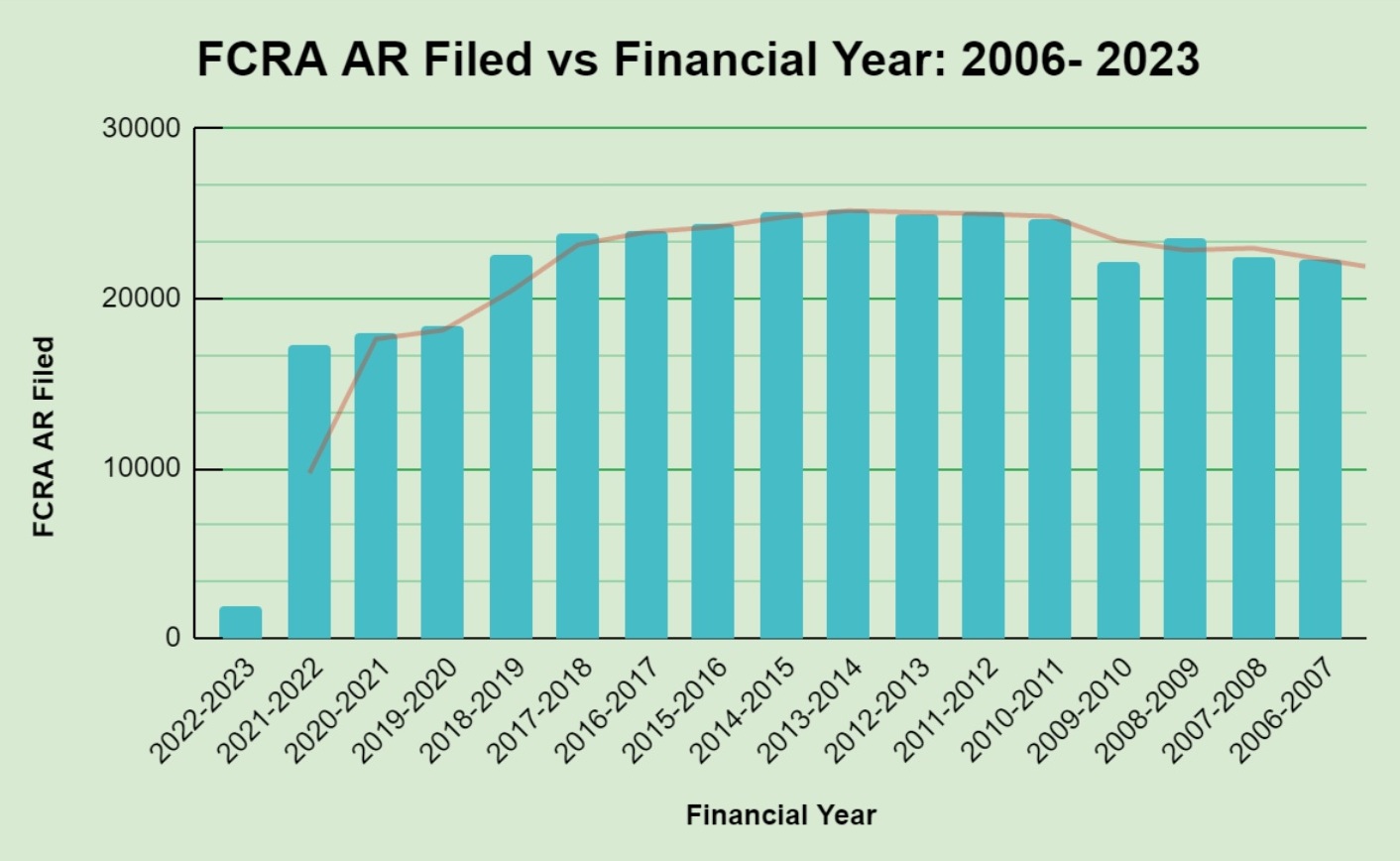

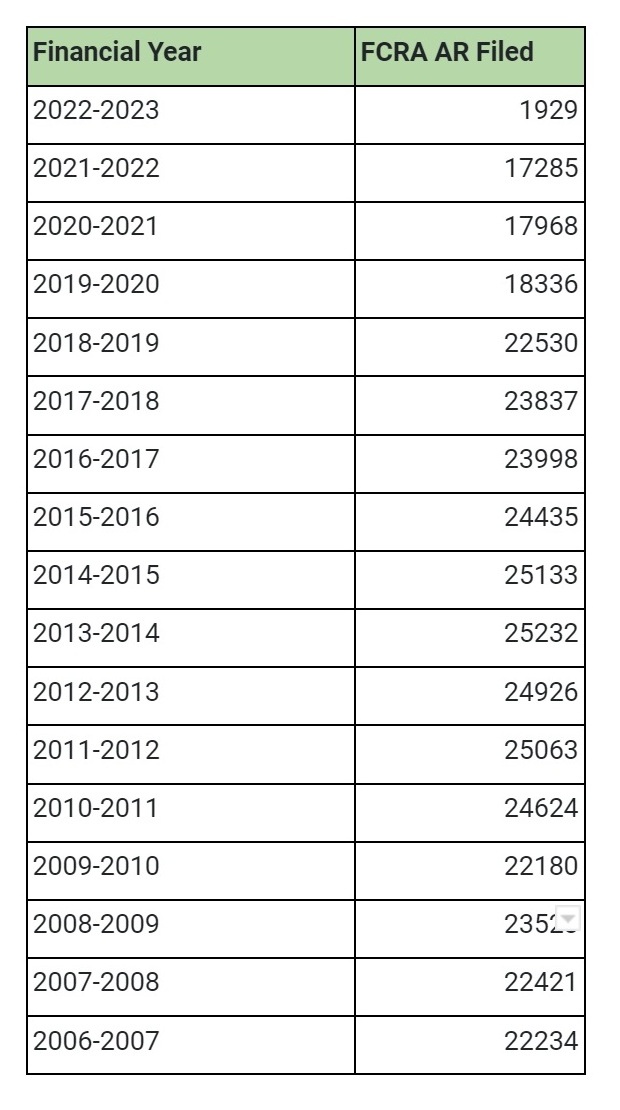

Annual Report submitted by FCRA Certified NGOs between 2006-23:

Based on the data analysis of the past 21 financial years, the lowest number of FCRA Returns was filed in 2022-23. However, between 2012 and 2014, over 25,000 FCRA returns were submitted by the registered societies. Please refer to the table below for detailed FCRA Annual report statistics. (Data Source: https://fcraonline.nic.in/fc_dashboard.aspx; Dated: October 19, 2023).

.jpg)