New Delhi, 23 January 2021: With a host of changes in the CSR rules, the annual CSR reporting format also changes for corporates now. According to the Ministry of Corporate Affairs, the companies will now have to separately furnish the details of project-wise unspent CSR budget and the excess expenditure during the reporting year.

Also Read:

The new CSR rules by MCA also makes it mandatory for companies to provide the weblink which details out the CSR functionary of the company along with CSR activities.

Further, as per the new rules, the ‘Impact Assessment’ for the previous CSR projects become mandatory.

CSR Reporting under new CSR rules - Key changes

- Companies need to provide the web-link where Composition of CSR committee, CSR Policy and CSR projects approved by the board are disclosed on the website of the company.

- A document carrying details of Impact Assessment of CSR projects carried out earlier

- Financial details of unspent CSR amount of the last three years

- Details of unspent CSR amount deposited in specified account

- Details of Excess CSR expenditure available for set off for the financial year

- CSR-1 Form filing becomes an additional requirement

Below are the format details as per the changed CSR rules:

1. Excess CSR spent and Amount available for set-off

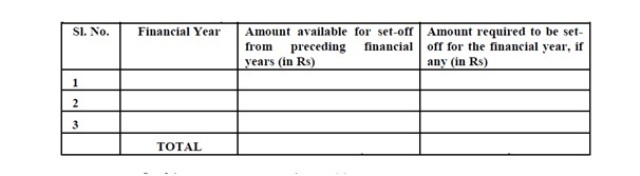

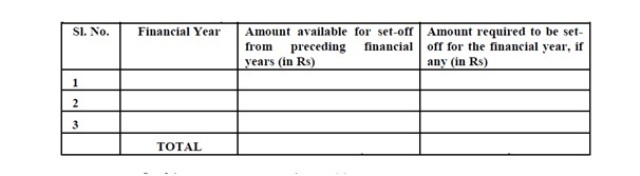

The companies which spent more than the prescribed CSR budget will now have an option to offset the excess CSR expenditure over the next three years. Accordingly, the amount required to be set off in a financial year has to be provided in the below format:

Further, the following details are now required in the annual report:

(a) Two percent of average net profit of the company as per section 135(5)

(b) Surplus arising out of the CSR projects or programmes or activities of the previous financial years.

(c) Amount required to be set off for the financial year,

(d) Total CSR obligation for the financial year (a+b-c).

2. Details of Unspent CSR amount to be deposited in specified CSR account

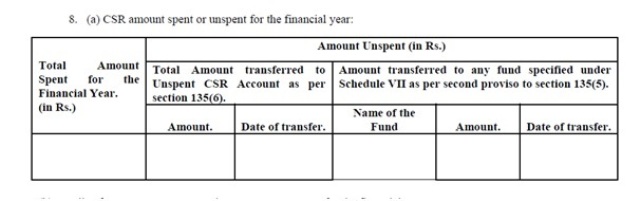

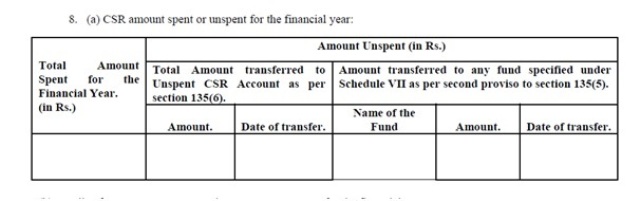

The unspent CSR amount will now have to be detailed out with information on ‘total amount transferred’ and ‘Date of Transfer’. The format for the above details below:

3. Details of prescribed CSR budget, total CSR spent and excess CSR spent

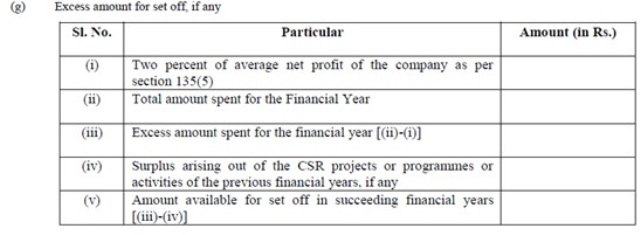

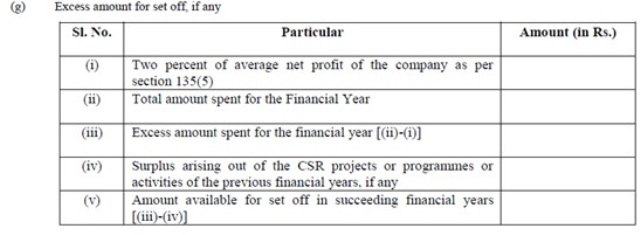

The prescribed budget of the CSR for the reporting period, the total expenditure on CSR in the period, the surplus amount arising out of the CSR projects and the excess CSR spent will have to be reported clearly in the prescribed format below:

4. Disclosure of the details of unspent CSR amount

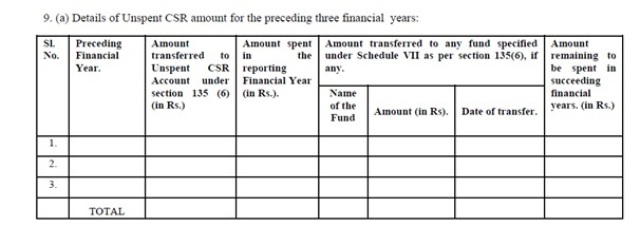

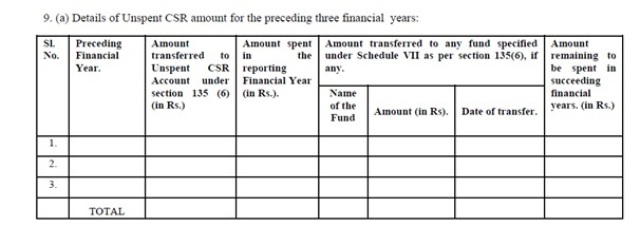

Now the companies will have to report each and every detail regarding their unspent CSR budget over last three years as well. Also, they will have to report any amount spent from the unspent CSR pool for the CSR projects in the reporting year.

5. CSR registration Number

Besides, the financial disclosure, the companies doing CSR activities will now have to register themselves with the Central Government by filing the form CSR-1 electronically with the Registrar, with effect from 01st April, 2021. The Form CSR-1 shall be signed and submitted electronically by the entity and shall be verified digitally by a Chartered Accountant in practice or a Company Secretary in practice or a Cost Accountant in practice. On the submission of the Form CSR-1 on the portal, a unique CSR Registration Number shall be generated by the system automatically.

.jpg)